Custody

Secure Custody.

Trusted Infrastructure

SCRYPT offers a licensed custody solution for digital assets with multi-layer security, institutional-grade risk management, and seamless access to trading & staking

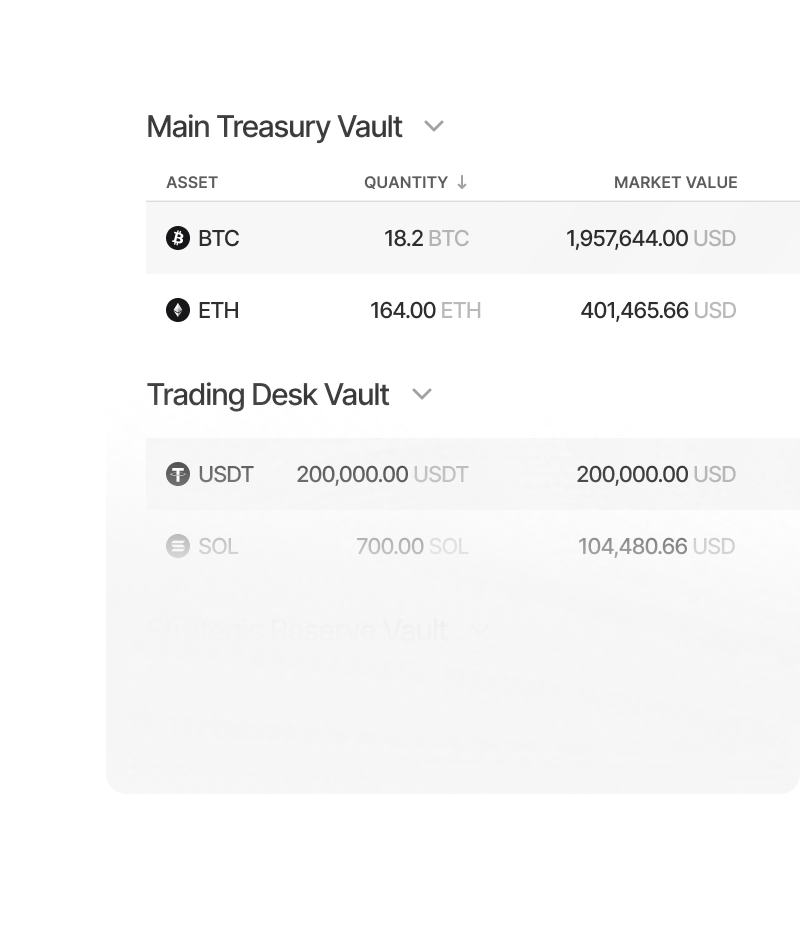

Portfolio Breakdown

$ 414,997.00

USD

USDC

USDC

Total share

5%

CHF

Swiss Frank

Total share

18%

BTC

Bitcoin

Total share

30%

ETH

Ethereum

Total share

2%

Our Advantages

Why Custody with SCRYPT

Swiss regulatory oversight combined with institutional-grade crypto infrastructure, built to secure and scale your operations

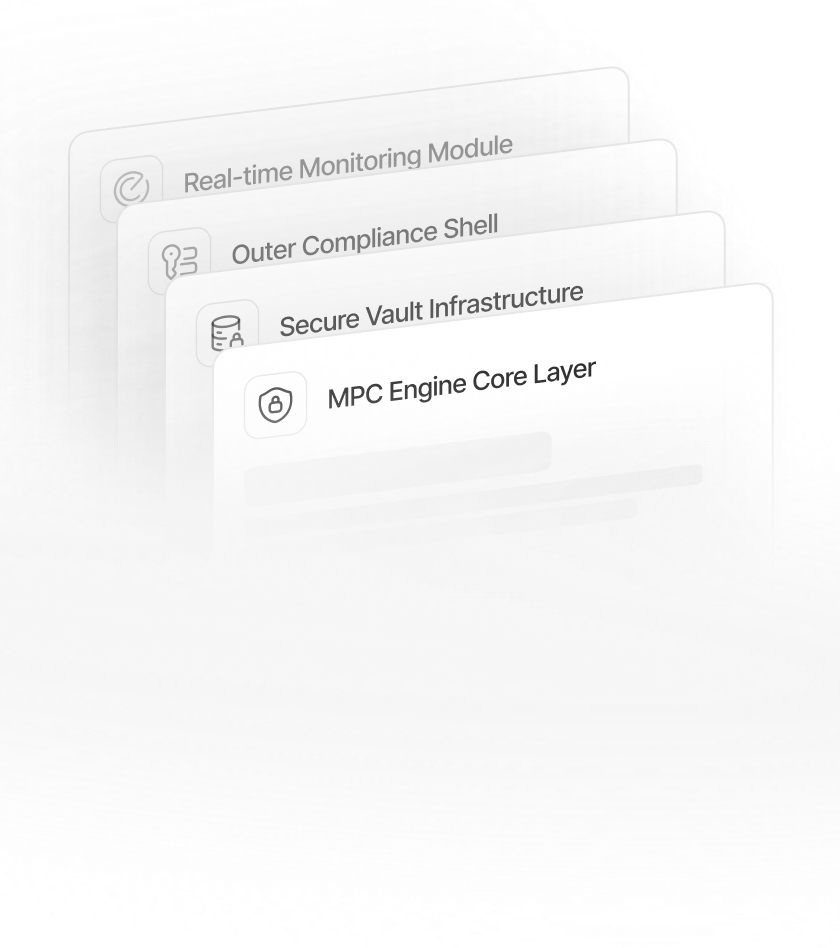

Inside SCRYPT

How It Works

Deposit Assets Securely

Secure deposits with advanced MPC-backed custody, built on trusted, industry-leading infrastructure

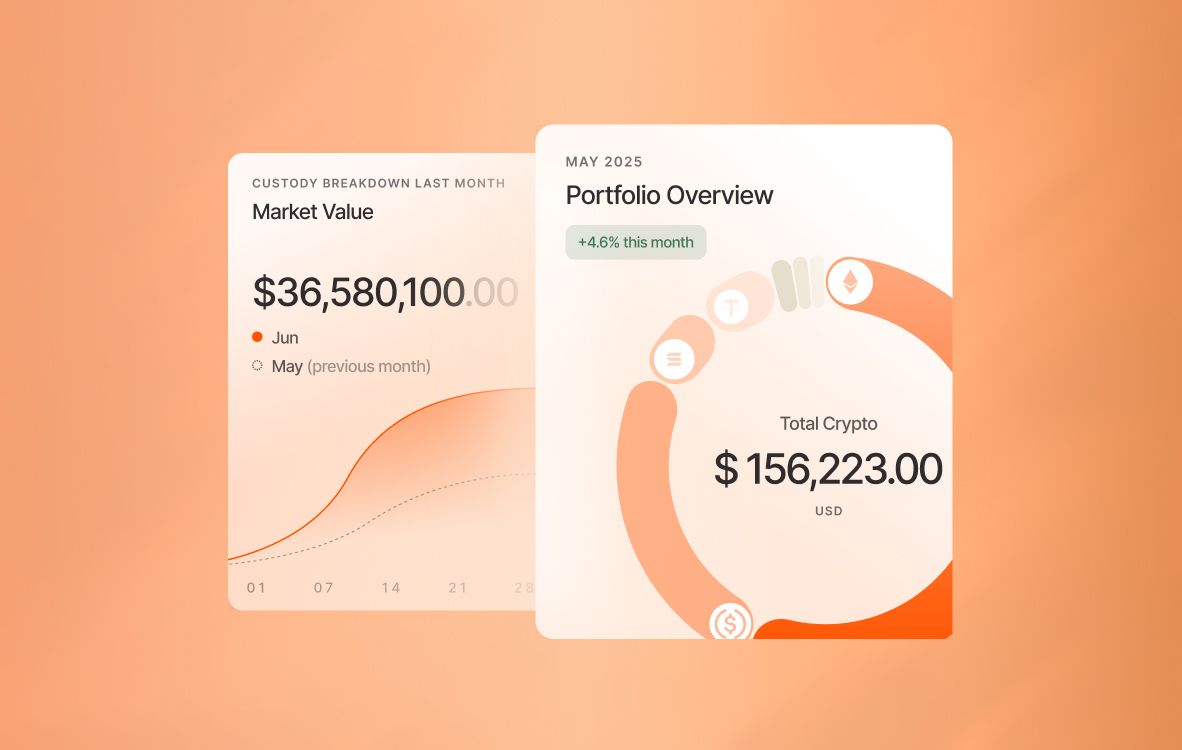

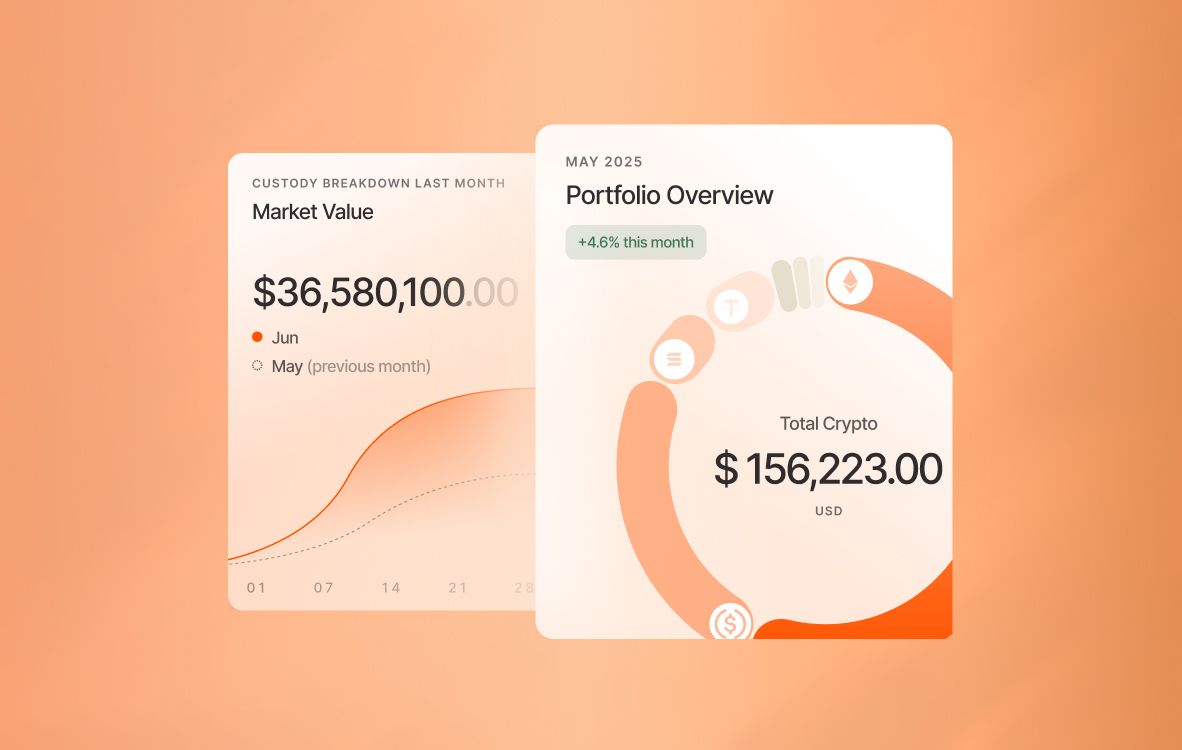

Monitor in Real Time

Track every movement and gain live portfolio insights with full visibility via our institutional-grade dashboard

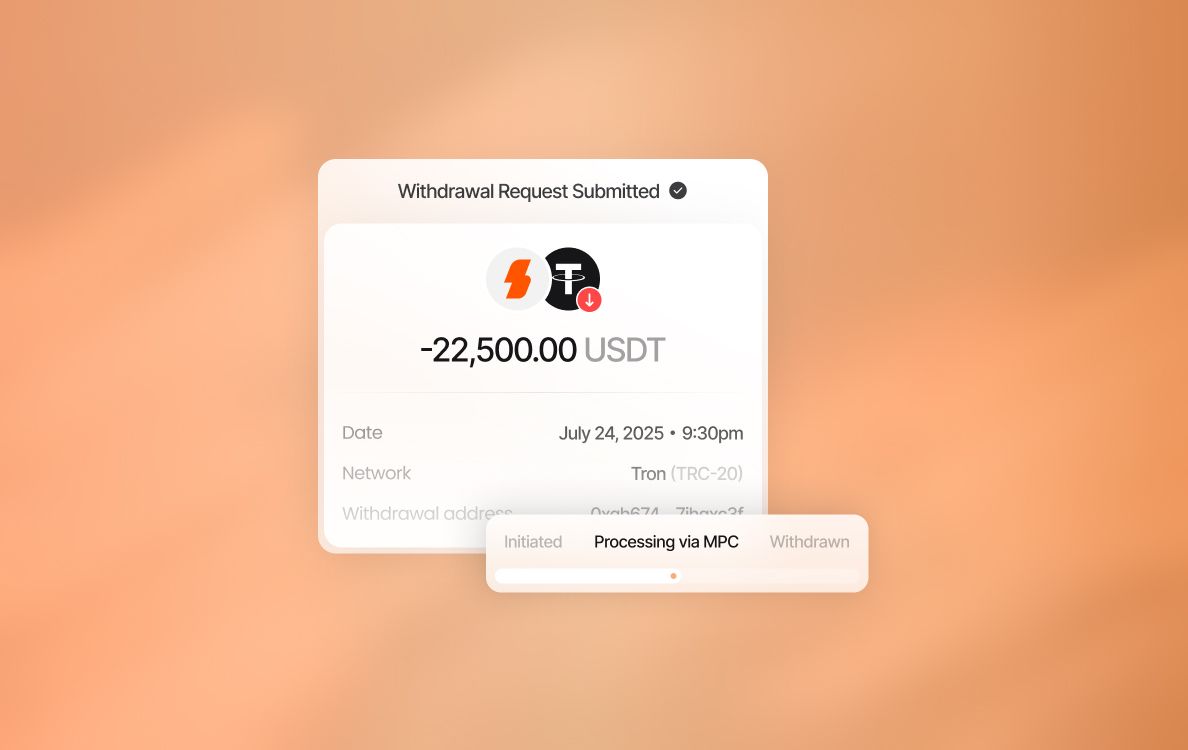

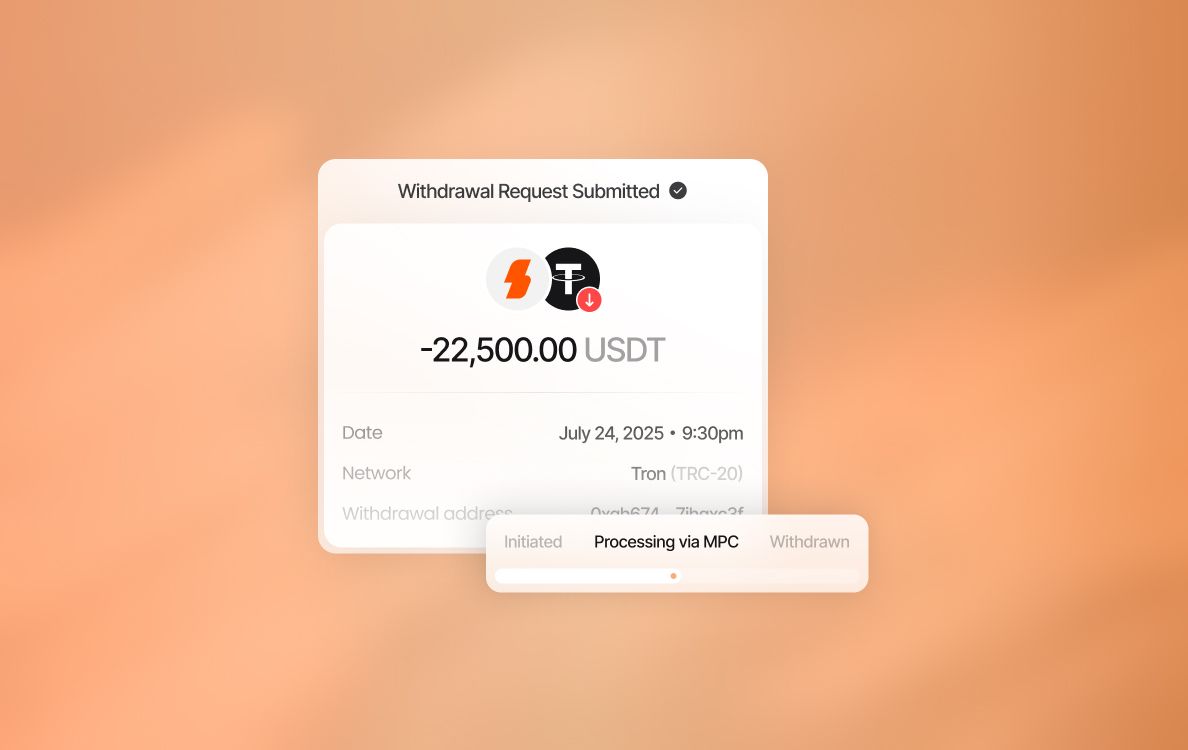

Withdraw Seamlessly

Withdraw anytime with certainty: no lockups or delays, your funds always remain liquid and execution-ready

Deposit Assets Securely

Secure deposits with advanced MPC-backed custody, built on trusted, industry-leading infrastructure

Monitor in Real Time

Track every movement and gain live portfolio insights with full visibility via our institutional-grade dashboard

Withdraw Seamlessly

Withdraw anytime with certainty: no lockups or delays, your funds always remain liquid and execution-ready

Global Assurance

Certifications & Compliance

SCRYPT’s custody infrastructure meets the highest operational, security, and compliance standards

Powered by

Swiss Regulatory Oversight

VQF-supervised under AMLA for full auditability and legal clarity

SOC 2 Type II & ISO Certified

Infrastructure adheres to global standards for operational integrity, availability, and data security

CCSS Level 3 & FIPS 140-2 HSMs

The highest level of cryptocurrency security certification, covering key management, operations, and infrastructure

FIPS 140-2 Level 3 HSMs

Hardware-backed key protection using certified modules, trusted by leading enterprises

Independent Pen Testing

Regular penetration tests and audits by ComSec and NCC Group to validate infrastructure resilience.

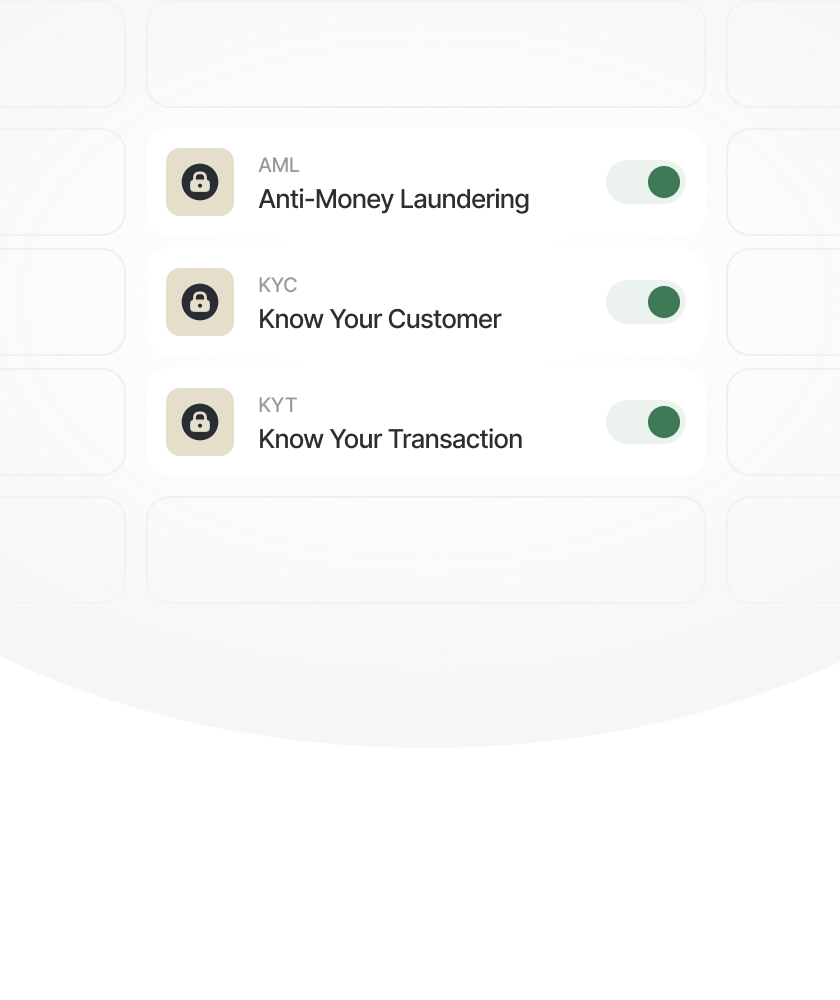

AML & Travel Rule Compliance

Real-time KYT/AML monitoring to ensure regulatory compliance across jurisdiction - powered by Chainalysis and industry-leading compliance partners

Insurance-Backed Protection

Disaster recovery and key loss coverage, underwritten by A-rated global insurers

Testimonials

What Our Clients Say

01/07

FAQ

SCRYPT Frequently Asked Questions

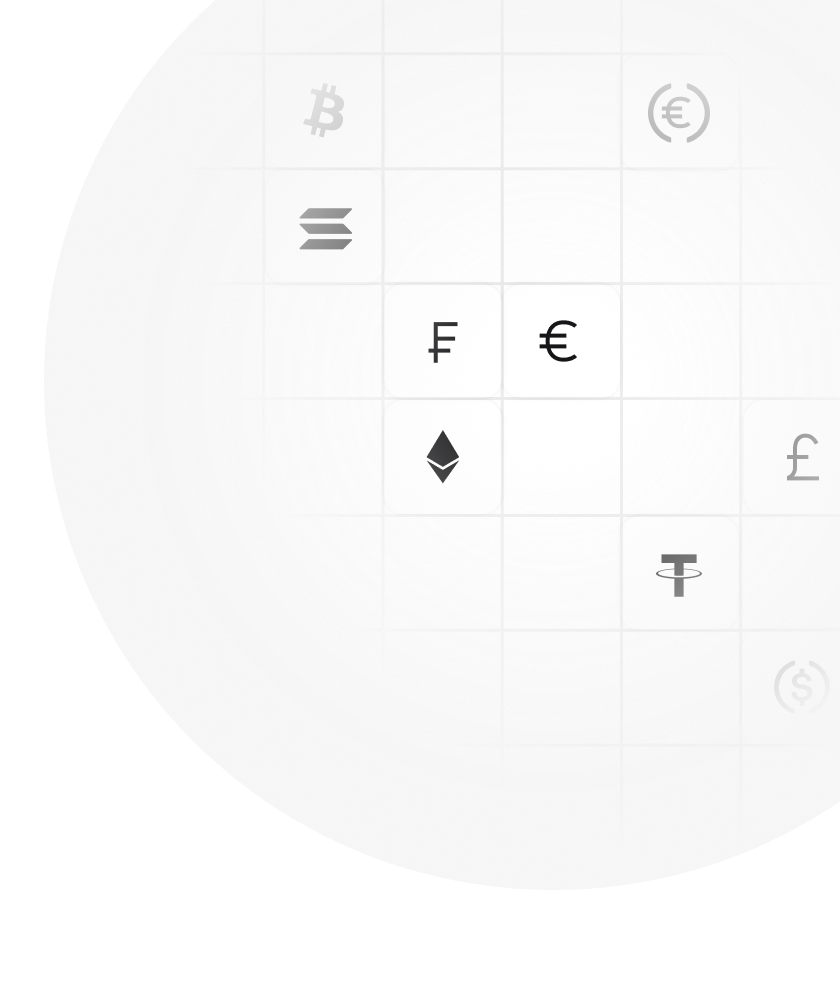

We support over 1,100 assets, including major cryptocurrencies, tokens, and stablecoins.

Absolutely. SCRYPT custody is built for institutions. Client's assets are secured with MPC infrastructure, real-time controls, and full regulatory oversight, including further insured-backed protection against key loss or theft through our Coincover partnership. Not just secure - safeguarded, auditable, and trusted at scale.

Yes. SCRYPT uses a fully segregated custody model - each client has dedicated sub-wallets per asset. Wallets are structured across hot, warm, and cold layers to balance real-time access with maximum security, tailored to your operational and risk needs.

Trusted Storage.

Backed by 24/7 Support

SCRYPT delivers a secure, compliant, and responsive custody solution tailored for your institutional needs